Following a year of broad economic uncertainty that stifled growth for hotels, hospitality industry leaders are looking toward 2026 with cautious optimism.

Rising operational costs are slated to challenge owners this year and lower-tier segments could struggle amid a growing wealth bifurcation. However, opportunities loom on the travel and technology fronts. And through it all, hotel companies are expected to fortify their portfolios with new brand offerings and partnerships.

As the year gets underway, Hotel Dive spoke with hospitality leaders from varying corners of the industry about their 2026 predictions. Below are the top trends expected to impact hotel operations, performance, net unit growth and more this year.

Hotel labor costs continue to rise

In 2026, hospitality professionals can expect labor costs to rise.

Total salaries, wages and benefits paid by U.S. hotels rose to $127 billion in 2025, according to data from the American Hotel & Lodging Association, shared with Hotel Dive. In 2026, that figure is projected to climb to $131 billion, representing a roughly 3% year-over-year increase, per AHLA.

For hotel owners, rising labor costs pose a challenge to net operating income growth, Kevin Davis, Americas CEO at JLL Hotels & Hospitality, told Hotel Dive.

“We’ve seen increased labor costs, increased cost of property taxes and insurance, and these are enduring issues that the owners fight across the country,” Davis said. “It is an absolute concern.”

Rising labor costs have been a challenge for hoteliers for years, Davis said, particularly following the COVID-19 pandemic.

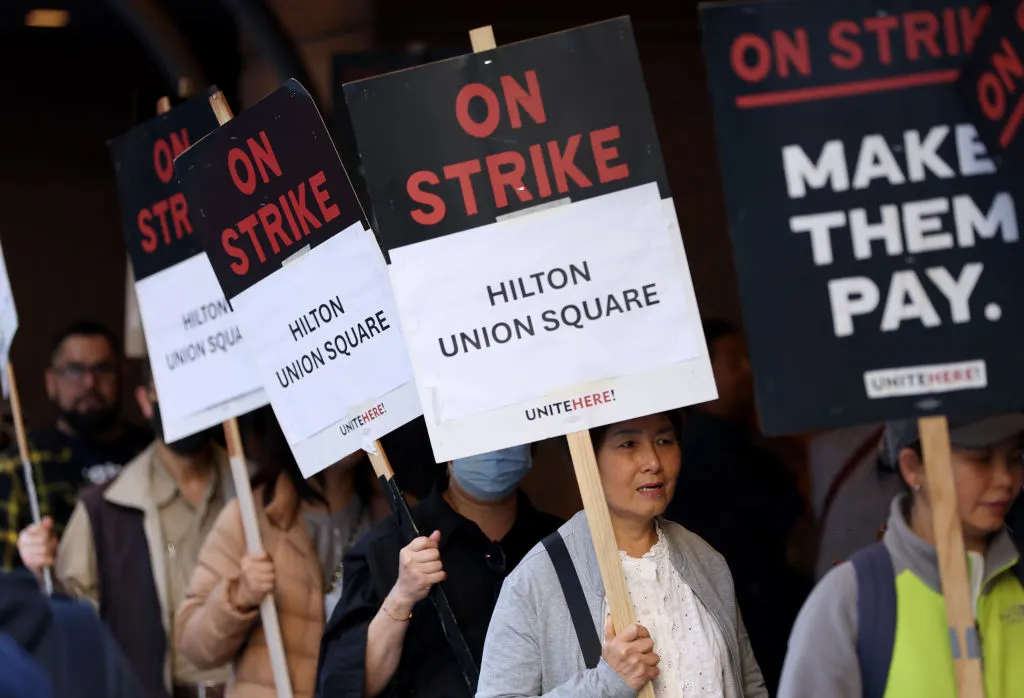

Overall, hotel labor costs have increased 15.3% from 2019 to 2025, outpacing the 12.8% growth in total operating revenue, according to AHLA. In recent years, thousands of union hotel workers have gone on strike demanding higher wages in order to keep up with the rising cost of living in places such as California, Hawaii and Las Vegas.

In 2026, Davis noted, union negotiations will be “front and center” in New York City, where the New York Hotel and Gaming Trades Council’s union contract with the Hotel Association of New York City is set to expire in July.

“Higher wages and the money we need to secure our medical and pension benefits” will be a top priority for hotel workers, HTC President Rich Maroko said in an April letter to his constituents.

Last year, the union backed New York City’s newly elected Mayor Zorhan Mamdani, who ran on a promise to raise New York City’s minimum wage to $30 per hour by 2030. Hotel industry associations, including AHLA, have denounced similar legislation across the country, including the recently passed $30 wage ordinance in Los Angeles.

“Our employees are the heart of hospitality and our industry takes pride in paying competitive wages, and in some parts of the country, the hotel industry pays among the highest wages,” AHLA President and CEO Rosanna Maietta told Hotel Dive, adding that “Americans across the country are feeling the strain of rising costs.”

At the same time, she said, “hoteliers’ operating costs have skyrocketed over the past five years,” with insurance up more than 100%, utilities up nearly 30% and property maintenance up nearly 25%.

“Demand has not kept up with this pace,” she said. “We’re also seeing these challenges compounded by legislation that targets hotel operations, such as extreme labor and licensing policies like the New York City Safe Hotels Act. When demand is falling and costs are soaring, the math simply doesn’t add up.”

Salaries, wages and payroll-related expenses paid by hotels now account for more than 32% of total revenue, according to AHLA. In the coming year, the organization will call on local, state and federal governments to “prioritize policies that strengthen tourism and address the roots of the ongoing affordability crisis, including lowering housing costs,” Maietta said.

Agentic commerce begins to reshape hotel booking

As more hotel guests turn to artificial intelligence to enhance their travel experience, booking hotels directly through large language models (LLMs) may be next, hospitality experts said.

Agentic commerce — a process by which autonomous AI agents act on behalf of a consumer to find, compare and complete purchases — is a trend that has accelerated across industries like retail. As consumers increasingly use AI to plan and book travel, agentic commerce will start to reshape the hotel booking process, according to hospitality and technology professionals.

According to PwC’s 2025 Holiday Outlook report, 76% of millennials said they’re likely to use AI for travel recommendations. A smaller percentage (57%) said they’d be likely to use it for booking travel. But that number is growing, Jonathan Kletzel, PwC’s travel, transportation and logistics leader, told Hotel Dive.

“The number of consumers that are searching [via LLMs] for products and services in travel has ballooned in the last 12 months and is accelerating every day,” Kletzel said, adding that inevitably, hotels will “take a hard look at how they can enable commerce and transactions through agentic [AI].”

“[Brands] can build on the trust they already have if they do a great job with how they handle AI in 2026."

Michael Klein

Head of retail, travel and hospitality product marketing at Talkdesk

To stay competitive with direct booking, larger multibrand hotel companies will “embed LLMs into their own brand websites and mobile apps, and change the way the consumer searches,” Kletzel said. “We’re going to see a gradual elimination of the date, location and brand preference search box on these hotel websites, and that will eventually get replaced with an LLM.”

Agentic commerce represents “a change in the distribution landscape for hotel inventory,” Kletzel said, because most big brands work to ensure “they’re at least present in every distribution channel that’s available to them.”

All hotel companies and brands in 2026 should be exposing their content to LLMs, whether for a model they embed on their own site or elsewhere, said Kletzel. “If you are not discoverable in an LLM search result — which many brands aren’t, and this is the big panic that they’re all going through right now — consumers aren’t going to consider you,” he said.

Michael Klein, head of retail, travel and hospitality product marketing at AI customer experience platform Talkdesk, similarly told Hotel Dive that hospitality players need to ensure their property information is being indexed by LLMs to appear in traveler queries.

Showing up in search is one thing. But how long will it take travelers to routinely use LLMs for hotel booking? Both Kletzel and Klein said the answer is tricky, since consumers don’t broadly trust the technology to effectively transact their hotel bookings yet.

“There’s a lot to overcome on the trust side,” Kletzel said. However, “consumers, over time, get comfortable dealing with new ways to interface with brands and products,” so it’s only a matter of time for that trust to be built. Meanwhile, the technology will improve and accelerate that process, he added.

Currently, LLMs lack rich imagery and content, such as pictures of the rooms and amenities, that consumers typically demand when making hotel bookings, Kletzel said. When this is enhanced, including by brands exposing their content to LLMs, that will be “a big leap forward to getting consumers comfortable.”

Hotel guest loyalty and brand trust, meanwhile, has rapidly expanded in recent years. Brands “can build on the trust they already have if they do a great job with how they handle AI in 2026,” Klein said, particularly speaking about booking systems.

Beyond the guest experience, agentic commerce has the potential to shift the way hotel companies’ customer service teams operate and are structured, Klein said.

“Will there be some corporations that find the opportunity to lower staff? Yes,” Klein said. But brands that believe in great customer experience and service will learn that AI could help their agents “get involved in more complex, more business-critical conversations that help grow the business.”

In 2025, Hyatt reduced staff by approximately 30% across its guest services and support teams “in response to the evolving nature of guest inquiries and shifting business needs,” per the company. Marriott International also laid off a small portion of its customer service staff last year.

Newly launched collection brands grow legs

This year, several collection brands that launched in 2025 will continue to expand. Additional new brands and partnerships, particularly in the lifestyle segment, will likely debut as well, according to hospitality professionals.

In 2025, Marriott launched two collection brands: Series by Marriott, playing in the upscale space in the U.S., and Outdoor Collection, exclusively focused on outdoor accommodations in destinations near national parks, deserts, ski areas and shorelines. Hilton and Hyatt, meanwhile, each debuted upscale collection flags.

Wyndham Hotels & Resorts unveiled its Dazzler Select brand extension targeting independent hoteliers in the economy lifestyle segment. And IHG Hotels & Resorts touted its own forthcoming upper-tier collection brand during third-quarter earnings.

In 2026, these new brands are expected to expand their portfolios and pipelines. Hilton’s Outset Collection, specifically, has more than 60 hotels in the works across the U.S. and Canada, Kevin Osterhaus, president of lifestyle brands at Hilton, told Hotel Dive. Outset is currently exploring possible new locations in San Diego, Los Angeles and Virginia Beach, Virginia, as well as markets in New Mexico and Colorado in 2026, Osterhaus said.

Collection brands remain “a massive opportunity,” as “more than half of the global hotel supply is unbranded or independent, mostly in the upscale to upper midscale segment,” Osterhaus said. “Collection brands are appealing because they offer the best of both worlds: Owners keep the unique DNA of their property, while unlocking global distribution, revenue management, loyalty and support. Guests get one-of-a-kind stays with the reassurance of a trusted brand.”

“As long as brands are purpose-built and distinct in experience and price point, they add clarity rather than confusion.”

Kevin Osterhaus

President of lifestyle brands at Hilton

From the guest perspective, independent boutique hotels are desirable because they offer authentic experiences, Gabriel Perez, chief operating officer of lodging at The Indigo Road Hospitality Group, told Hotel Dive.

“Travelers seem to be enjoying and craving experiences that are unique and not replicated anywhere else,” Perez said. However, as for why the hotel companies are chasing independents in the lifestyle segment, “it’s not about the guests. It’s about creating sub-brands within their own brands to satisfy investors’ needs and to satisfy owner and developers’ goals,” Perez said.

JLL’s Davis echoed that sentiment, telling Hotel Dive that the industry is at the point of, if not past the point of, brand saturation, as “public companies [are] under a tremendous amount of pressure for net unit growth.” This, in turn, puts even more pressure on hotel companies “to create brands, micro brands and subsets of brands in order to expand their footprint of existing assets,” Davis said.

Osterhaus said one of Hilton’s biggest opportunities for net unit growth in 2026 is growing its collection brands because they give owners a compelling way to differentiate in competitive markets while preserving each hotel’s unique identity.

Hilton’s collection brands’ “distinct positioning and storytelling continue to drive interest across chain scales,” Osterhaus said.

According to Bobby Molinary, Marriott’s chief development officer for select brands, interest in Marriott’s new collection brands comes amid a challenging high-cost-of-construction environment that has made it “increasingly difficult to build new hotels.”

Series and Outdoor Collection, both conversion-friendly offerings, pertain to an ownership community and developers who “are constantly looking for ways to grow, and conversions represent a path for growth,” Molinary said.

To satisfy investors, hotel companies will continue to launch new brands, including collection brands, regardless of whether oversaturation in the marketplace results in guest confusion, Perez said.

According to Osterhaus, “As long as brands are purpose-built and distinct in experience and price point, they add clarity rather than confusion.”

This year, Hilton plans to remain “very active in the lifestyle space through strategic partnerships, new signings and ongoing growth of our current brands,” Osterhaus said.

Molinary expects Marriott competitors to begin providing some type of branding solution in the outdoor space, specifically, as “it’s a really popular and growing space” with “a lot of interest.”

Luxury dominates amid a wealth bifurcation

Another growing space is the luxury segment. Luxury hospitality boosted results in key urban markets in the first half of 2025 and helped drive Q3 RevPAR gains. That trend is expected to continue in 2026 as luxury consumers drive travel spending and hotel bookings amid a wealth bifurcation at play in the industry.

“High-net-worth travelers are expected to remain one of the most reliable drivers of global travel spending next year,” Giray Boran, managing director of BLG Capital, told Hotel Dive.

Boran said that this group has been “especially active in the current cycle.” As a result, he said, the pipeline of projects catering to them will continue to expand, with developers adding amenities that offer privacy, wellness and distinctive experiential environments.

Jordan Robinson, senior vice president at Modern Currency public relations, said that in 2026, ultra-high-net-worth travelers will continue to prioritize private, discreet, personalized vacations. This will translate to more interest in hotels with club floors, private access and private villas.

Luxury travelers are also booking trips around “big cultural tentpole moments” such as the Route 66 centennial, Super Bowl and Olympics, Robinson said. “Ultra luxury travelers want hotels that feel very plugged into the local fabric of what’s happening and can offer reprieve, convenience, exclusive access and also that luxury relaxation.”

However, with a growing divide between luxury travelers and their more price-conscious peers, some segments of the hospitality sector may struggle to gain market share.

“Americans across the country are feeling the strain of rising costs.”

Rosanna Maietta

President and CEO of the American Hotel & Lodging Association

“As the gap between luxury travelers and the rest of the market grows, the industry is seeing clear differences in performance,” Boran said. “Middle-market hotels are feeling more pressure, while luxury properties continue to attract consistent demand.”

Alessandro Colantonio, chief investment officer at investment firm Gencom, offered a counterpoint to that observation, saying luxury’s high prices could bring industrywide benefits.

“Luxury assets are driving the high [room] rates,” Colantonio said. “And what that does is, it lifts all the boats. If you've got a full-service or select-service asset that was charging $200 a night, and a luxury product is moving into this $800-, $900- or $1,000-a-night racket, you’re going to slowly inch your property up. The high rates at the luxury end lift up the other segments.”

Colantonio added that some consumers who stay in lower segment hotels also like to have dinner at luxury hotel restaurants. “So, I do think that luxury will continue to drive the overall segment, but you need both ends of it for it to work,” he said.

Potential gains in the luxury sector are also likely to stimulate investor interest, according to Colantonio.

“You’ll see new players starting to move into that [luxury] segment,” Colantonio said, noting that while there might be a smaller pool of buyers, the individual luxury investment transactions would be larger, on average, than in other sectors. “I think you’re [also] going to start to see a trend of more [investors] shifting over to the luxury segment, or at least trying to be competitive in that luxury segment.”

In addition, Colantonio said asset improvement will play an important role for luxury investors in the coming year.

“You have to continue to look at your competition and see what they’re doing, and you have to keep up,” Colantonio said.

Big events bolster hotel performance

Hotels in the U.S. are gearing up for big events in 2026, including FIFA World Cup, which will be held across 11 cities, and America’s 250th anniversary in July.

Brad Busby, executive vice president of hospitality at Dallas-based RREAF Holdings, said the company is anticipating an increase in both direct and indirect bookings for the World Cup. Overall, the company is anticipating a 5% to 20% bump in June and July, though he acknowledged that prediction range is “pretty wide.”

Despite the draw of major events, economic factors like tariffs, changes to the visa process and inflation are holding travel flat, said Jan Freitag, national director of hospitality analytics for CoStar Group.

“Demand-wise, it could just be a wash,” Freitag said of big cities hosting events this year.

Corporate event planners that might normally consider one of these host cities for a conference, for example, may go elsewhere to avoid bigger crowds or inflated lodging costs. At the same time, if travelers coming to an event from abroad are making a once-in-a-lifetime trip, “they are going to pay for the rooms,” he said.

RREAF, meanwhile, is anticipating more bookings at its beachfront properties this year, as visitors who come to the U.S. for World Cup matches may want to do additional traveling while in the country, Busby said.