PHOENIX — The state of the economy has a significant effect on hotel performance, so as uncertainty lingers well into 2025, what can industry professionals expect for future growth?

Hotels have been impacted this year by policy changes and travel disruptions, with top companies reporting widespread U.S. RevPAR declines in the second quarter of the year and industry analysts lowering full-year growth forecasts.

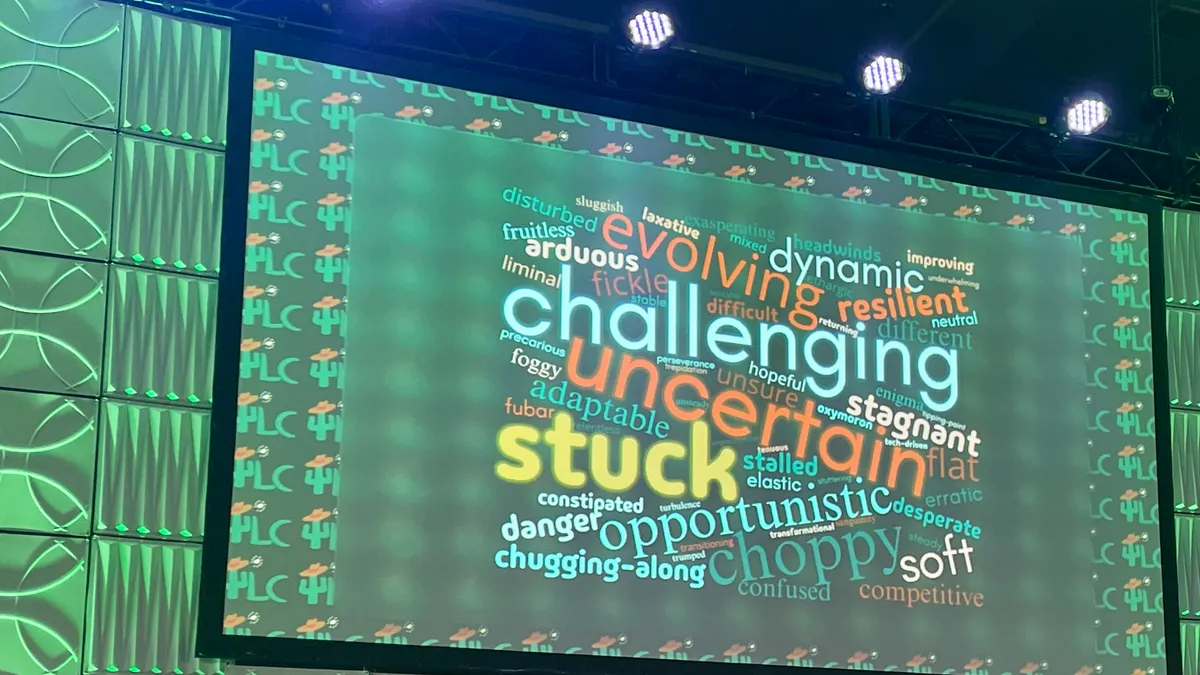

For the remainder of 2025 and into 2026, the hotel industry will have to approach growth more strategically, implementing cost-effective solutions to weather a turbulent economy. During various sessions at The Lodging Conference this week, hospitality executives and economists shared what’s ahead for hotels.

The current state of travel demand

The hotel industry is “stuttering,” said Isaac Collazo, head of analytics at CoStar Group subsidiary STR. Room demand in August — the most recent month with a full data set — had fallen for five consecutive months, Collazo said during a Tuesday session at the conference focused on hotel demand and performance trends. He noted that September is expected to post demand declines as well.

Andrea Grigg, senior managing director and global head of hotel asset management at CBRE Hotels, called out weaker business and inbound international travel at the conference.

During Q2 earnings calls this summer, hotel company CEOs pointed to a dip in international inbound travel, with a lack of Canadian tourism, specifically, impacting Las Vegas resorts. Several chief executives also cited declined government travel as a contributing factor to domestic RevPAR declines.

In May, the World Travel & Tourism Council reported that the U.S. was on track to lose $12.5 billion in international visitor spending in 2025. Meanwhile, from April to July, an increased number of global travel buyers canceled U.S.-based meetings and sought travel partners outside of the country as a result of recent U.S. government actions, according to the Global Business Travel Association.

During a Wednesday morning panel, Marriott International CFO Leeny Oberg shared that 40% of the transient business in the U.S. has a booking window of less than four days, which is “about as short as I've seen it in my time,” she said.

In June at the NYU International Hospitality Investment Forum, STR President Amanda Hite warned of shortened booking windows ahead of the summer months. As summer neared a close, in August, CoStar and Tourism Economics further lowered their growth outlooks for 2025 and 2026 demand, RevPAR and ADR. The firms expect RevPAR to decrease 0.1% year over year in 2025, with ADR rising 0.8% and occupancy dipping to 62.5%.

Performance is weakened

Collazo said Tuesday he expects CoStar’s full-year 2025 outlook to be lowered again in November when the company publishes its next forecast.

This is on the heels of U.S. hotel RevPAR remaining weak in the third quarter, decreasing in July, August and the first two weeks of September, according to CoStar data.

Approximately 40% of all U.S. submarkets were losing ADR as of August, according to Collazo, citing CoStar data. The “only time we’ve seen that before is during real economic recessions,” he said.

Occupancy, meanwhile, will stay declined in 2026 before rising back above 63% in 2027, Collazo forecast.

Rising costs add fuel to the fire

Rising operating expenses are adding fuel to the fire for hotel owners who are already seeing decreased revenues.

“Revenues [are] not matching the growth in expenses,” Collazo said. Later on in the same talk, CBRE’s Grigg shared a similar sentiment.

Hotel labor costs, specifically, were up 2.6% year over year in July, according to CBRE data shared by Grigg during the session. Meanwhile, as of July, technology costs at hotels increased 5% year over year, franchise fees and related fees rose 3.9% and maintenance costs increased roughly 5%, Grigg shared. Rising insurance costs are also a significant burden to hoteliers, experts shared throughout the conference.

To combat rising costs, hotel owners need to optimize staffing levels and embrace technology, Grigg said. If that doesn’t happen, profit margins could continue to widen.

Most hotel segments in the U.S. saw year-over-year gross operating profit losses in July, with the midscale/economy segment seeing the steepest decline of 7.8%, according to CBRE data. In addition, the resort, luxury and upper-upscale segments were the only three chain scales to see increases in gross operating profit for the period.

Luxury segment leads

The CBRE data tells “a tale of two industries,” according to Grigg, who explained there is a bifurcation of the hotel industry happening, where luxury travelers are thriving and lower-tier travelers are doing the opposite.

Marriott’s Oberg echoed that sentiment during a fireside chat at the conference on Tuesday — though her exact words were “a tale of two environments.”

There is a “growing wealth gap” in the U.S., a country that is overwhelmingly dependent on domestic travel, Oberg explained. On one end, there is a growing group of travelers 55 years and older who control more than 70% of the U.S. financial wealth, she said. “They are healthy. They are retiring. And they love to travel.”

On the other end, half of the U.S. population makes under $75,000 a year, she noted, and “what’s currently going on with inflation impacts them meaningfully more than the upper-end.” Inflation on basics alone “takes up a bigger chunk of their income,” Oberg said.

With this in mind, the hotel industry will need to rely increasingly on wealthy travelers, according to Grigg. She noted that as long as luxury travelers have disposable income, hotels in the segment will continue to outperform.

One category that does continue to perform well in lower-tier chain scales, though, is extended stay, executives shared throughout the conference.

The asset class has proven to be resilient in the face of uncertainty, with a significant portion of hotel owners saying they see the product type as “an investment with great potential” in Wyndham Hotels & Resorts’ Hotel Owner Trends Report, published in June. The survey also found that owners anticipate an increase in new extended stay business over the next five years.